The Ultimate Overview to Locating the Best Tough Money Lenders

Browsing the landscape of hard money loaning can be an intricate undertaking, calling for a thorough understanding of the numerous aspects that add to a successful borrowing experience. From evaluating lending institutions' reputations to comparing rate of interest and fees, each step plays an important duty in protecting the finest terms possible. Establishing efficient communication and offering a well-structured business plan can dramatically influence your interactions with lending institutions. As you think about these elements, it ends up being apparent that the path to recognizing the ideal hard cash lender is not as simple as it may appear. What crucial understandings could better boost your technique?

Comprehending Hard Cash Lendings

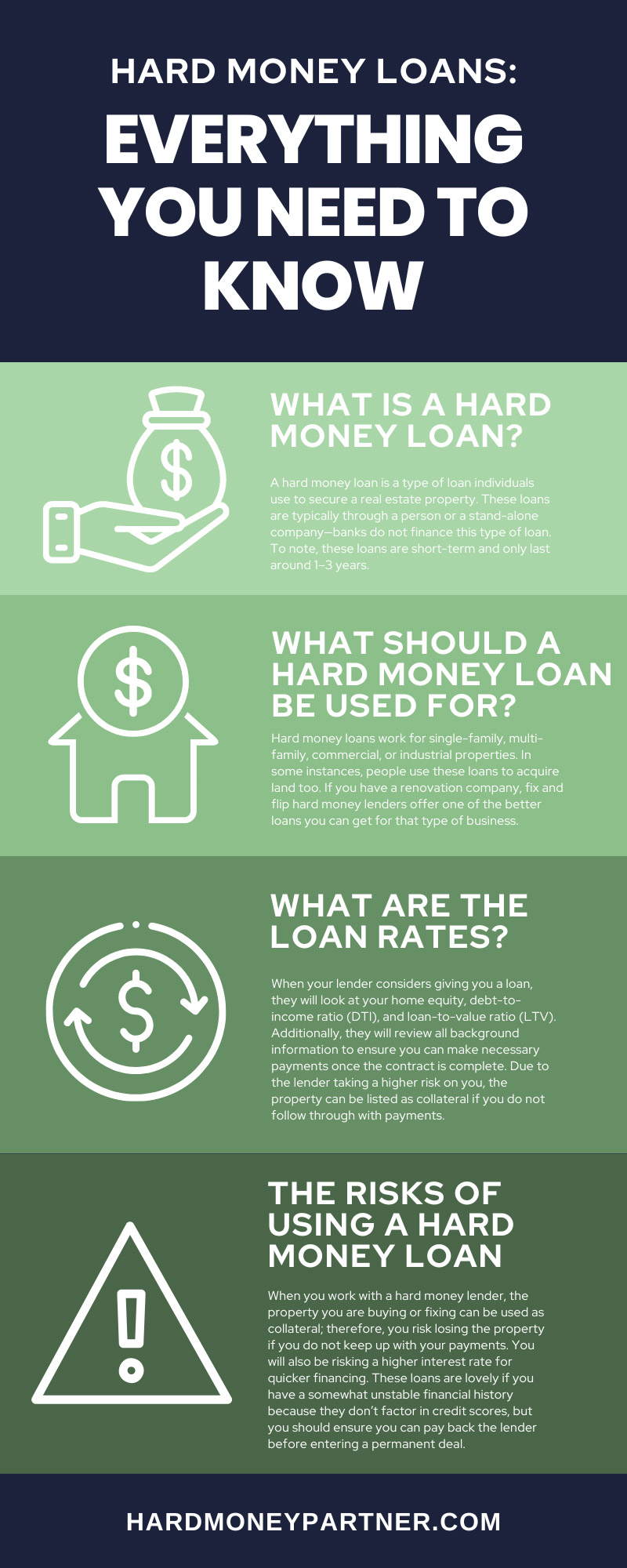

Comprehending difficult cash fundings involves acknowledging their unique qualities and objectives within the realty funding landscape. These car loans are normally protected by genuine estate and are offered by exclusive loan providers or financial investment teams, differentiating them from conventional home mortgage items supplied by banks or credit report unions. Difficult money lendings are largely utilized for temporary financing requirements, usually facilitating fast deals genuine estate investors or designers who need instant capital for building purchase or improvement.

One of the defining features of hard cash lendings is their reliance on the worth of the building instead of the borrower's credit reliability. This permits borrowers with less-than-perfect credit report or those looking for expedited funding to gain access to capital more easily. Furthermore, hard cash car loans normally include higher rates of interest and shorter repayment terms contrasted to conventional lendings, showing the raised risk taken by lenders.

These car loans offer different objectives, including funding fix-and-flip tasks, refinancing troubled homes, or giving funding for time-sensitive chances. Because of this, understanding the nuances of tough money finances is important for capitalists that intend to utilize these monetary tools properly in their actual estate ventures.

Trick Variables to Take Into Consideration

When evaluating hard money loan providers, what crucial aspects should be focused on to make certain an effective purchase? A reliable lender should have a proven track record of completely satisfied customers and effective offers.

Following, think about the terms of the funding. Various loan providers provide varying rates of interest, costs, and settlement timetables. It is vital to recognize these terms completely to prevent any unpleasant shocks later on. Furthermore, examine the lender's financing rate; a swift approval procedure can be crucial in competitive markets.

One more crucial factor is the lending institution's experience in your certain market. A lender acquainted with regional problems can supply valuable understandings and may be extra versatile in their underwriting procedure.

Exactly How to Evaluate Lenders

Reviewing hard money lending institutions entails a systematic technique to guarantee you pick a partner that aligns with your investment objectives. A reputable lender ought to have a background of successful transactions and a strong network of pleased consumers.

Following, examine the lender's experience and expertise. Different loan providers might concentrate on numerous kinds of residential or commercial properties, such as domestic, industrial, or fix-and-flip jobs. Select a loan provider whose experience matches your financial investment approach, as this expertise can significantly impact the authorization procedure and terms.

An additional essential variable is the lending institution's responsiveness and interaction design. A trustworthy loan provider must be prepared and accessible to address your concerns comprehensively. Clear communication throughout the examination process can indicate exactly how they will certainly manage your car loan throughout its duration.

Lastly, make certain that the loan provider is transparent about their procedures and demands. This consists of a clear understanding of the documentation required, timelines, and any type of conditions that might apply. When choosing a tough money lender., taking the time to examine these aspects will certainly empower you to make an educated decision.

Contrasting Rates Of Interest and Charges

A thorough contrast of rates of interest and fees among tough money lending institutions is vital for optimizing your investment returns - ga hard money lenders. Tough money finances frequently feature higher rate of interest prices compared to standard funding, usually varying from 7% to 15%. Understanding these rates will certainly aid you evaluate the possible prices associated with your financial investment

In enhancement to rate of interest, it is critical to assess the connected costs, which can significantly affect the total loan expense. These charges might consist of origination fees, underwriting charges, and closing expenses, usually expressed as a percentage her explanation of the funding quantity. Origination charges can vary from 1% to 3%, and some lenders may charge additional fees for processing or administrative jobs.

When contrasting loan providers, consider the complete expense of borrowing, which encompasses both the passion rates and fees. Be certain to inquire concerning any type of possible early repayment charges, as these can influence your capability to pay off the car loan early without sustaining additional charges.

Tips for Effective Borrowing

Next, prepare an extensive company plan that outlines your task, anticipated timelines, and top article monetary forecasts. This demonstrates to lenders that you have a well-thought-out approach, boosting your reputation. In addition, keeping a solid connection with your lender can be beneficial; open interaction cultivates depend on and can result in more desirable terms.

It is likewise necessary to guarantee that your residential or commercial property fulfills the loan provider's criteria. Conduct a thorough assessment and view it supply all required documents to improve the authorization process. Be mindful of leave techniques to settle the car loan, as a clear settlement plan comforts lenders of your dedication.

Conclusion

Furthermore, hard cash finances typically come with higher passion rates and much shorter payment terms compared to traditional car loans, mirroring the boosted risk taken by lending institutions.

When reviewing hard cash lenders, what crucial elements should be focused on to guarantee an effective transaction?Reviewing tough cash loan providers involves a methodical approach to ensure you pick a partner that straightens with your investment objectives.A comprehensive contrast of interest rates and costs among difficult cash lenders is vital for optimizing your investment returns. ga hard money lenders.In summary, situating the best difficult cash lenders requires a complete examination of different components, consisting of lender track record, financing terms, and specialization in residential property kinds

Comments on “Explore the Best GA Hard Money Lenders for Real Estate and Investment Financing”